How Mileagewise - Reconstructing Mileage Logs can Save You Time, Stress, and Money.

How Mileagewise - Reconstructing Mileage Logs can Save You Time, Stress, and Money.

Blog Article

Getting The Mileagewise - Reconstructing Mileage Logs To Work

Table of ContentsFacts About Mileagewise - Reconstructing Mileage Logs UncoveredFacts About Mileagewise - Reconstructing Mileage Logs Revealed9 Simple Techniques For Mileagewise - Reconstructing Mileage LogsEverything about Mileagewise - Reconstructing Mileage LogsThe Facts About Mileagewise - Reconstructing Mileage Logs UncoveredNot known Factual Statements About Mileagewise - Reconstructing Mileage Logs Mileagewise - Reconstructing Mileage Logs for Dummies

Timeero's Shortest Range attribute suggests the shortest driving path to your workers' destination. This attribute enhances efficiency and contributes to set you back savings, making it an important asset for companies with a mobile labor force.Such a technique to reporting and conformity streamlines the often complex job of managing gas mileage expenditures. There are numerous advantages linked with using Timeero to keep track of gas mileage.

Mileagewise - Reconstructing Mileage Logs Can Be Fun For Anyone

These added confirmation procedures will certainly maintain the IRS from having a factor to object your mileage documents. With exact gas mileage monitoring modern technology, your employees don't have to make rough gas mileage estimates or even fret concerning mileage cost tracking.

For example, if a staff member drove 20,000 miles and 10,000 miles are business-related, you can cross out 50% of all automobile costs. You will need to proceed tracking gas mileage for work even if you're using the actual expenditure method. Maintaining mileage documents is the only method to different service and personal miles and offer the proof to the internal revenue service

Many gas mileage trackers let you log your trips manually while determining the distance and repayment amounts for you. Lots of also featured real-time journey tracking - you require to start the application at the start of your journey and stop it when you reach your last destination. These apps log your beginning and end addresses, and time stamps, together with the total distance and repayment amount.

Mileagewise - Reconstructing Mileage Logs - An Overview

This consists of prices such as fuel, upkeep, insurance coverage, and the lorry's depreciation. For these prices to be taken into consideration insurance deductible, the vehicle ought to be made use of for organization functions.

The Facts About Mileagewise - Reconstructing Mileage Logs Revealed

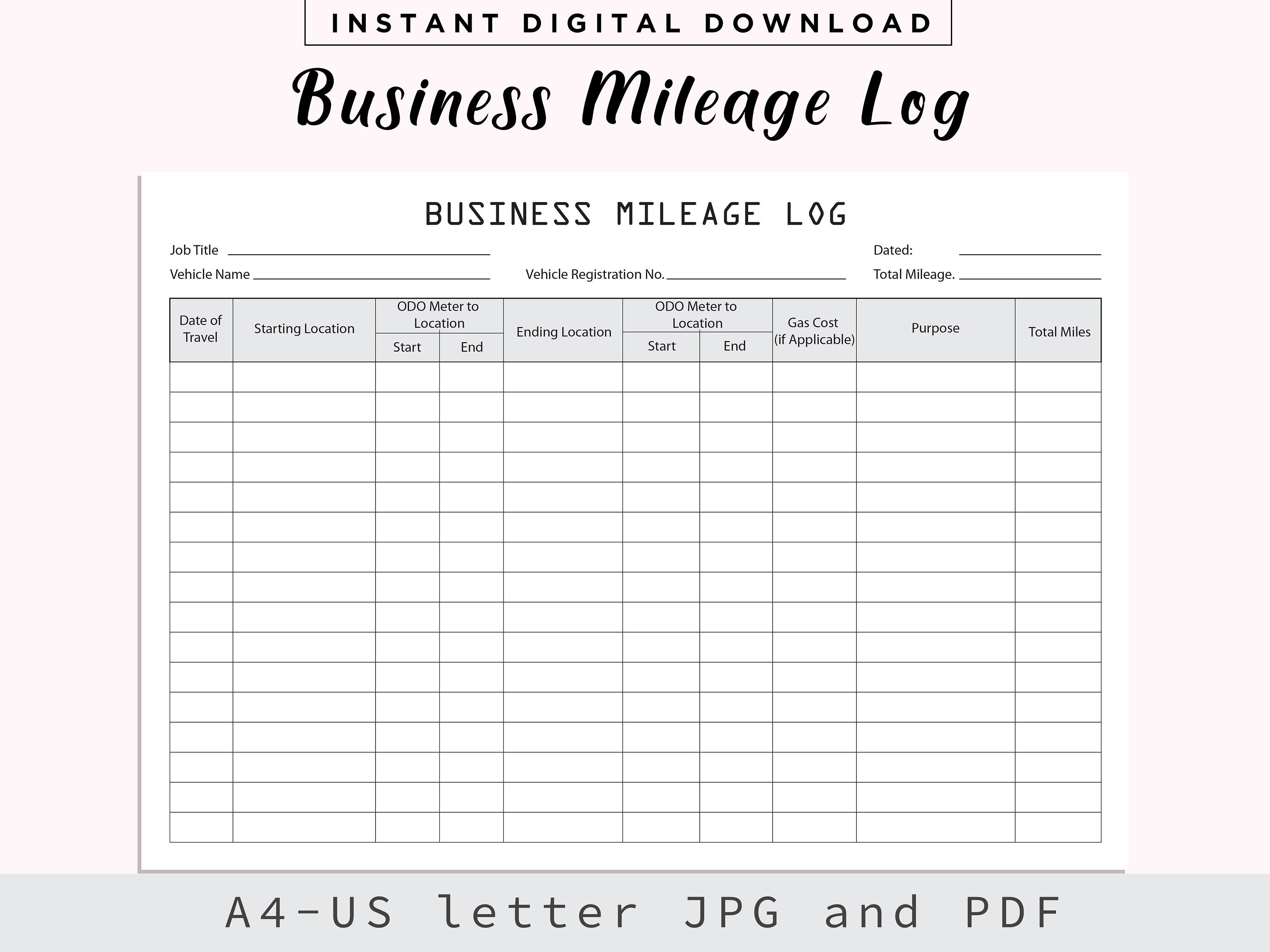

Start by videotaping your auto's odometer analysis on January 1st and after that once more at the end of the year. In in between, faithfully track all your organization journeys taking down the beginning and finishing analyses. For each trip, record the place and business objective. This can be streamlined by keeping a driving visit your vehicle.

This includes the overall service mileage and complete mileage buildup for the year (service + individual), trip's day, destination, and objective. It's important to videotape activities promptly and preserve a synchronous driving log describing date, miles driven, and service objective. Below's just how you can boost record-keeping for audit objectives: Start with ensuring a precise mileage log for all business-related traveling.

The 9-Minute Rule for Mileagewise - Reconstructing Mileage Logs

The real expenses method is an alternate to the common gas mileage rate approach. As opposed to calculating your deduction based upon an established rate per mile, the real expenditures technique permits you to subtract the real expenses related to using your automobile for business objectives - free mileage tracker. These prices consist of fuel, upkeep, repair services, insurance policy, devaluation, and various other relevant expenditures

Those with significant vehicle-related expenditures or unique problems may profit from the actual expenses approach. Eventually, your chosen approach should align with your certain monetary objectives and tax situation.

The 2-Minute Rule for Mileagewise - Reconstructing Mileage Logs

(https://moz.com/community/q/user/mi1eagewise)Calculate your complete service miles by using your begin and end odometer readings, and your recorded service miles. Precisely tracking your precise mileage for organization trips help in confirming your tax reduction, specifically if you choose for the Standard Mileage approach.

Maintaining track of your gas mileage manually can need persistance, however remember, it might conserve you money on your tax obligations. Tape-record the total gas mileage driven.

Some Known Questions About Mileagewise - Reconstructing Mileage Logs.

And currently almost everybody utilizes GPS to obtain about. That means nearly every person can be tracked as they go regarding their organization.

Report this page